Economics – 4/29/13

I. Bellwork: Q&A

A. Page 242 Economic Analysis

B. Page 244 Economic Analysis

II. Objective:

- Analyze the ways in which local, state, and federal governments generate revenue.

- Determine the meaning of words and phrases as they are used in a text

III. Video – How the Government Spends, Collects, & Owes

IV. Notebook Work:

V. iLearn Quiz – Chapter 9-1 & 9-2 Quiz online Today- Wednesday @ 3:30

What to study:

- Objectives for Sections 9-1 & 9-2

- Know vocabulary words

- Progressive, Regressive, and Proportional tax & Examples of each

- Guided Reading 9-1- Ability to Pay & Benefit Principle

- Incidence of a tax/graphs pg 231

- Impact of a tax on producers and consumers(inelastic/elastic conditions)

- Types of taxes pg 235

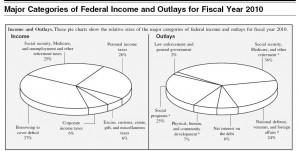

- Federal Revenue Sources (Pie Chart Above)

- State & Local Revenue Sources p 242

- Page 255 Visual Summaries

VI. Classwork

- Page 238 Content Vocabulary 15

- Page 245 # 2, 3, 7 Q&A

- Pages 251-253

- Describe Flat Tax and list its advantages (3) and disadvantages (3)

- Describe Value Added Tax and list its advantages (4) and disadvantages (1)

Leave a Reply