Economics – 11/30/18

I. Bellwork:

A.) Claim Statement:

Which type of tax (progressive, proportional, or regressive) do you believe is the most equitable way for the government to raise money? Provide support for your claim (at least two sentences explaining your claim.

II. Objective:

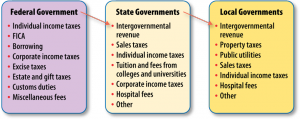

- Distinguish between the ways in which local, state, and federal governments generate revenue.

- Write arguments to support claims in an analysis of substantive topics or texts, using valid reasoning and relevant and sufficient evidence

- Determine the meaning of words and phrases as they are used in a text

III. Discussion & Notebook Work:

- Federal Revenue Sources (Pie Chart) Additional Info

- Income Tax Video

- State & Local Revenue Sources p 242

- Page 255 Government Revenue Sources

- Notebok Work: Pages 251-253

- Describe Flat Tax and list its advantages (3) and disadvantages (3)

- Describe Value Added Tax and list its advantages (4) and disadvantages (3)

IV. Classwork

- Page 238 Content Vocabulary 15 & Page 245 # 2, 3, 7 Q&A

Leave a Reply