Personal Finance – 4/26/17

I. Bellwork

- Explain in detail the charges the business owner faced.

- What was the sentence in the case?

- Do you agree? Explain

II. Objectives

- Content OBJ – given gross wages and allowances, calculate fed and state tax withheld from wages

- Discuss how Deductions, exemptions and tax credits reduce tax liability

- Complete IRS form W-4 (Employee’s Withholding Allowance Certificate) to determine the optimal amount to withhold for personal income tax.

- Lang OBJ – explain how to calculate fed and state tax withheld from wages

III. Notebook

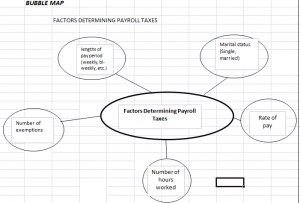

- Map – Factors Determining Payroll taxes

IV. Classwork

C) Page 89 Vocab (7) & Pg 96 #7-10

Leave a Reply