Economics – 12/15/2016

I. Bellwork:

- SAT READING QUESTIONS

II. Objective:

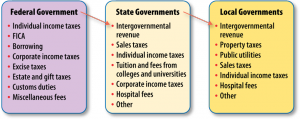

- Distinguish between the ways in which local, state, and federal governments generate revenue.

- Write arguments to support claims in an analysis of substantive topics or texts, using valid reasoning and relevant and sufficient evidence

- Determine the meaning of words and phrases as they are used in a text

III. Discussion & Notebook Work:

A. Federal Revenue Sources (Pie Chart) Additional Info

C. State & Local Revenue Sources p 242

D. Page 255 Government Revenue Sources

- Describe Flat Tax and list its advantages (3) and disadvantages (3)

- Describe Value Added Tax and list its advantages (4) and disadvantages (3)

IV. Classwork

- Page 238 Content Vocabulary 15 & Page 245 # 2, 3, 7 Q&A

- Claim Statement: Which type of tax (progressive, proportional, or regressive) do you believe is the most equitable way for the government to raise money? Provide support for your claim.

Leave a Reply