Personal Finance – 11/10/16

I. Bellwork

- Explain in detail the charges the business owner faced.

- What was the sentence in the case?

- Do you agree? Explain

II. Objectives

- Content OBJ – given gross wages and allowances, calculate fed and state tax withheld from wages

- Discuss how Deductions, exemptions and tax credits reduce tax liability

- Complete IRS form W-4 (Employee’s Withholding Allowance Certificate) to determine the optimal amount to withhold for personal income tax.

- Lang OBJ – explain how to calculate fed and state tax withheld from wages

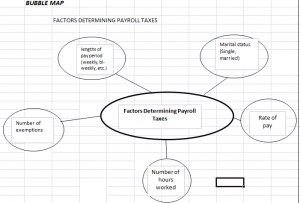

III. Notebook

IV. Classwork

- W-4 Form

- Completion of a W-4

- google classroom 6.1.39 Federal and State Withholding

Leave a Reply